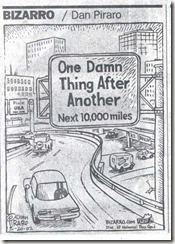

Demand forecasting is the holy grail of inventory control. The value of demand forecasting is almost axiomatic – it doesn’t really require a complex modeling exercise to prove it. However, corporate America is filled with stories about the forecasting pitfalls and problems. While there have been great discussions about various algorithms used to forecast demand, let’s take a fresh look at forecasting. Is forecasting science (defined algorithms) or art (human judgment and intuition)?

Forecasting algorithms are actually very well known mathematically, and it seems that graduate students in Operations Research (an area of applied mathematics) are coming up with new ones on a regular basis. While a time-series type approach may work for established products, other algorithms would be needed where there is little historical information or where the forecasted event is intermittent.

While algorithm performance varies depending on the situation (for example, exponential smoothing and double exponential smoothing work differently), any of them will outperform simply allowing the ordering process to run on autopilot. The mathematics behind these algorithms are quite elegant and provably correct. However, given that is the case, why did Nike has such a spectacular demand forecasting failure in 2004?

Science Meets Art

In the case of Nike, court documents demonstrated clearly that Nike relied too much on software to do the forecasting, rather than on people who were clearly part of the supply chain process. As one practitioner put it, you can always assume that the initial forecast will be wrong, especially if the algorithm is being fed bad or out-of-date data. So, let’s look at a couple of ways that forecast accuracy can improve.

The law of large numbers basically says that the more you have of something, the more accurate are your forecasts. Life insurance companies are so profitable because they have large pools of people, segmented by demographic and health factors, and can with a high degree of reliability predict how many will die in a given period. Most insurance companies exclude acts of war because that is something they just can’t model in their forecasts.

So, the first step is to aggregate the demand into batches large enough to increase the forecast accuracy. For example, let’s say there is a new product launch nationwide, and enough product needs to be ordered to meet demand. What are some steps marketing can take?

There are factors which include seasonality, point in the product lifecycle, weather, and any number of other data. It is difficult to provide an exhaustive list, but the point is that forecast accuracy improves as factors are introduced which more closely models reality.

Art Meets Organization

Aggregate demand is made up of segmented demand, and it’s a judgment call at to which customer segments make sense for a particular forecast. Marketing will have already done research on the expected market for a new product, and the customer segmentation they expect to materialize in the marketplace.

Sales will have a big say in whether the forecast is reasonable, since they will have to sign up for the number. If marketing’s forecast says there is demand for 1,000 shirts, sales needs to commit to finding the demand and selling into it. They will look at some of the same data as marketing, but will also work their sales channels to see if it can move that much merchandise.

Once sales is done with it, finance and operations will need to weigh in to make sure they can finance the inventory and the infrastructure exists to move that many shirts. A trade off is possible between the addressable market, the available market, and corporate resources.

As the foregoing implies, there is a process for getting to a forecast that ultimately turns into a sales order. The technology and original forecast was balanced against the organization and what it could accomplish. It is a balancing act, as has been discussed elsewhere.

Placing the Factory Order

All of this activity leads to the factory order. Once the order is placed, the challenge shifts from inventory size to inventory management. That will be a discussion for another time.

So, is forecasting an art or a science? Every forecasting situation is different because each product or service is different. Having said all that, forecasting is really art buttressed by science. Put in place processes and so forth to help the people use the science to generate good forecasts. The payoff is worth the effort.